Loan Calculator

With the loan calculation tool, you can easily access information such as the total interest payment, when the loan will expire, by adding the principal, annual interest rate, maturity and loan start date.

With the loan calculation tool, you can easily access information such as the total interest payment, when the loan will expire, by adding the principal, annual interest rate, maturity and loan start date.

Your Balance

%

Your interest rate

The types of loans may differ according to the central banks of the countries where the banks are affiliated. The most common types of loans are as follows:

It is based on the common calculation used in all loan types by using the loan calculation tool. In this way, you can easily learn the amount of interest and the total amount to be paid.

The loan interest is calculated by applying interest again to the principal remaining in the payment period. Any loan interest and taxes paid are deducted from the monthly installment and the loan principal is recalculated. Taxes are not included in our loan calculator. For a clearer result, visit the pages of the banks.

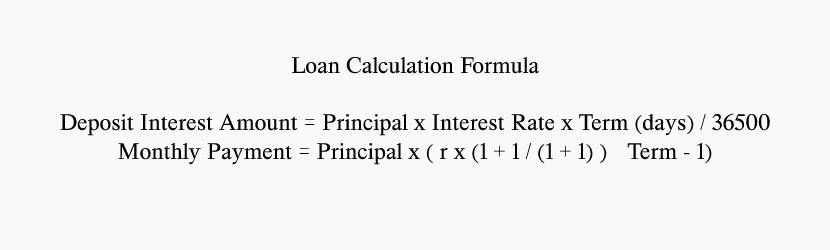

It is calculated as Deposit Interest Amount = Principal x Interest Rate x Maturity (days) / 36500.

We can calculate the monthly repayment amount as Monthly Payment = Principal x ( r x (1 + 1 / (1 + 1) )Maturity - 1.

The annual cost rate is the percentage rate of the total cost, which is formed by including all the fees that banks charge from the loan holders in the loan interest rate.

Banks receive the loan expenses and taxes they have incurred in the first place, even if the loan is closed early. However, since the interest to be applied to the already unpaid portion of the loan is not processed, there will be a decrease in the total payable amount calculated at the beginning.

The effective annual interest rate is expressed as a percentage of the total cost of the loan per year. To explain with an example, the amount to be paid for a 100-unit loan with an annual interest of 5% is 105 units.